florida inheritance tax amount

Thus each US citizen is entitled to exempt the set amount from estate taxation on assets held in. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no.

Estate And Inheritance Taxes Around The World Tax Foundation

Federal Estate Tax.

. How Much Is the Inheritance Tax. Florida residents are fortunate in. Doane Doane specializes in tax matters and other areas of law.

Florida Inheritance Tax and Gift Tax. No Florida estate tax is due for decedents who died on or after January 1 2005. This is the amount of money you can legally transfer.

Just because Florida does not have an inheritance tax does not mean you do not have to file taxes. No estate tax or inheritance tax Alaska. There is no estate tax in Florida as it was repealed in 2004.

At Instrumental Wealth we can help you understand and learn the nuances of Inheritance Tax Laws in Florida. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or. Florida residents may still pay federal estate taxes though.

For more details contact us at 813-578-7001. Any amount up to 117 million is. No estate tax or inheritance tax Arizona.

For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or. An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate. While Florida does not have an inheritance tax there is a federal inheritance tax.

Heres a breakdown of each states inheritance tax rate ranges. The laws surrounding inheritance and estate taxes in Florida are complex and it could be hard to understand your options without the assistance of an inheritance attorney. However this tax only applies to large estates in excess of 117 million.

You can contact us. If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the. Keep reading to discover more about probate inheritance tax in Florida.

There are several other tax filings that the survivor must complete and they include the. In 2019 the Federal Unified Gift and Estate Tax Exemption will increase from 1118 million to 114 million per person. The federal estate tax exemption for 2021 is 117 million.

The estate tax exemption is adjusted for inflation every year. No estate tax or inheritance tax California. Although the state of Florida does not assess an inheritance tax or an estate levy Florida doesnt charge one.

As a result no portion of what you leave to your family will go to. The size of the estate tax exemption means very. No estate tax or inheritance tax Arkansas.

If you have questions or need experienced legal counsel in Palm Beach County dont hesitate to contact.

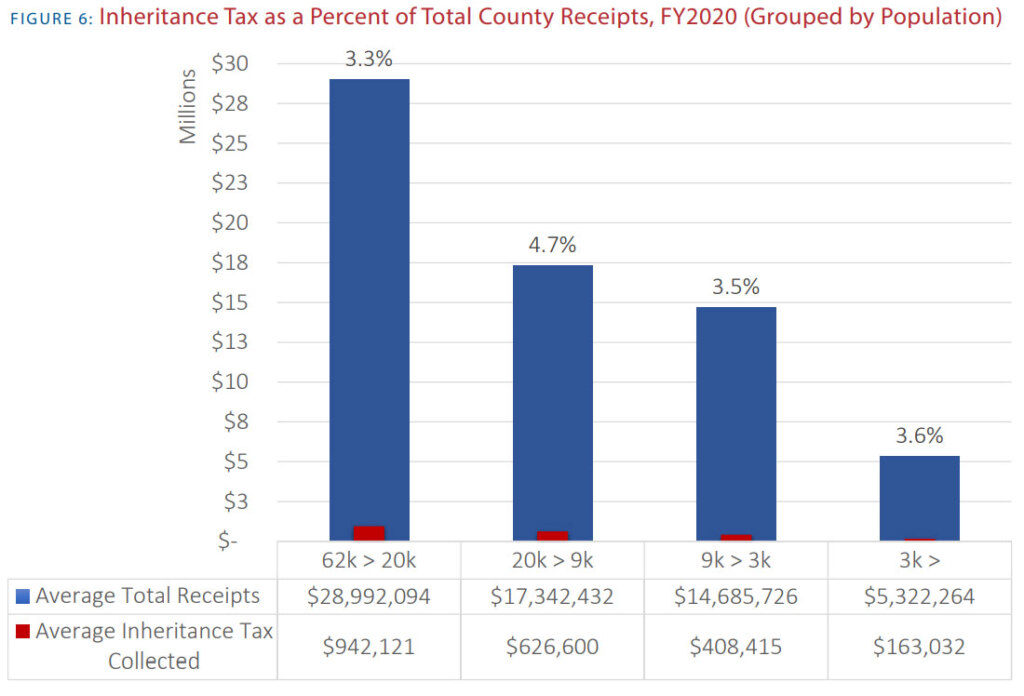

Death And Taxes Nebraska S Inheritance Tax

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

State Estate And Inheritance Taxes Itep

Florida Inheritance Laws What You Should Know Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

Inheritance Tax Here S Who Pays And In Which States Bankrate

Form Dr 308 Request And Certificate For Waiver And Release Of Florida Estate Tax Lien R 10 09

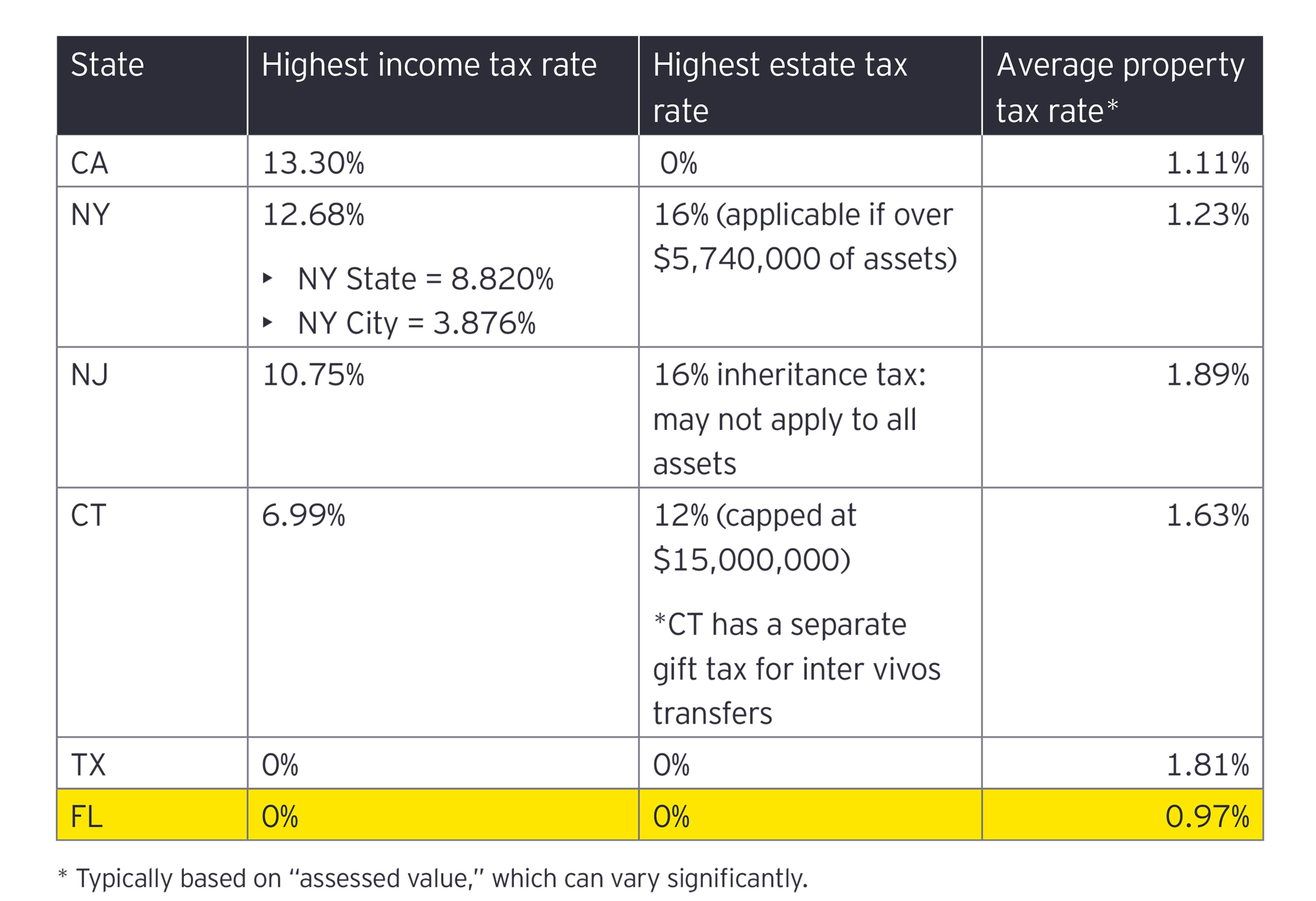

Tax Considerations When Moving To Florida Ey Us

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

The Death Tax Isn T So Scary For States Tax Policy Center

Expatriation From The United States Part 2 The Inheritance Tax

How Many People Pay The Estate Tax Tax Policy Center

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Is There An Inheritance Tax In Texas

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Does Florida Have An Inheritance Tax

16 States You Don T Want To Die In Florida Estate Planning Lawyer Blog January 23 2009